Last updated on January 2nd, 2026 at 12:32 pm

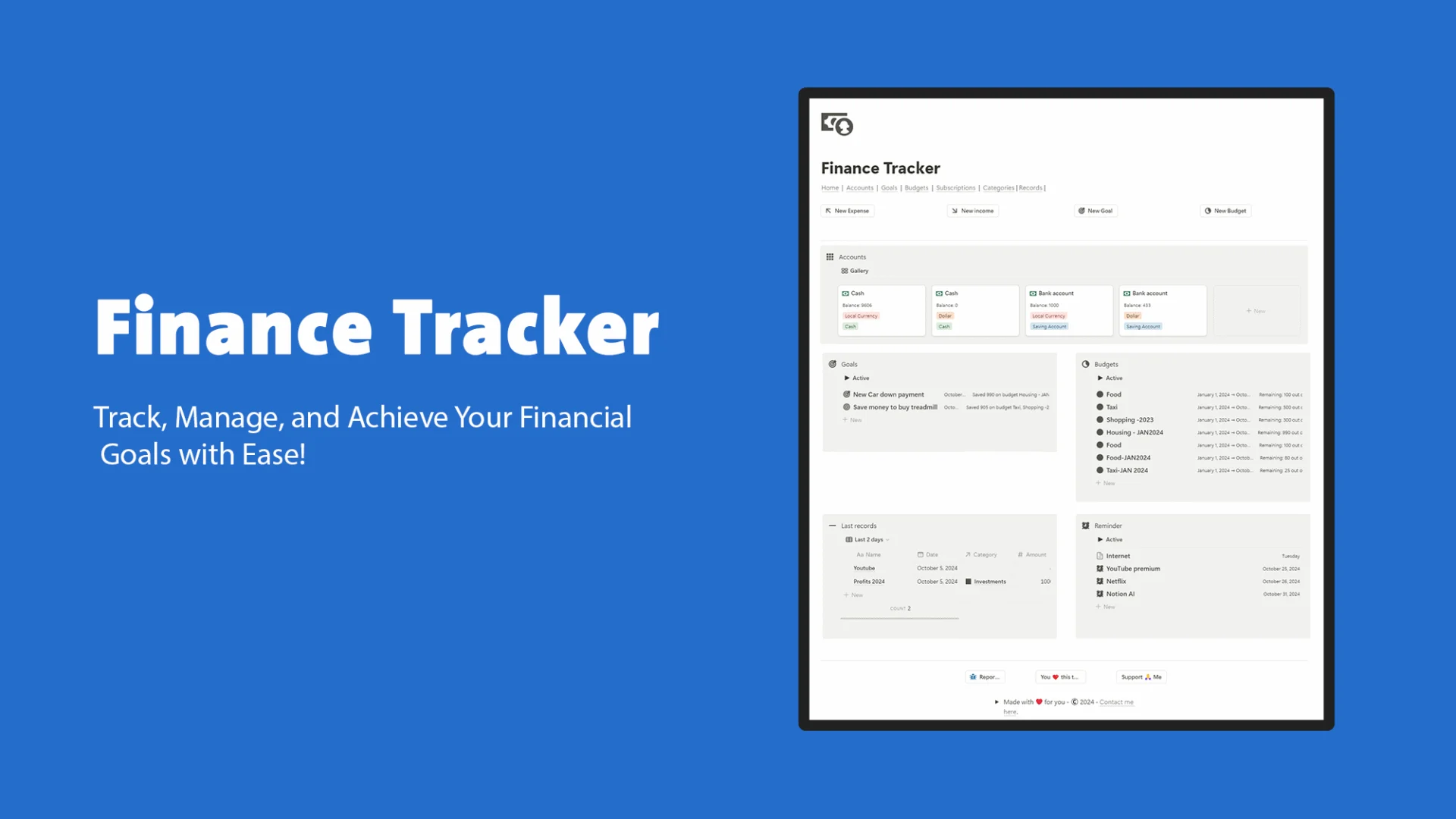

The Finance Tracker Notion template is a powerful tool for managing your finances. It is designed to help you keep track of your accounts, budgets, expenses, subscriptions and goals all in one place.

With this template, you can easily monitor your spending habits, stay on top of your bills, and work towards your financial objectives.

The Finance Tracker Notion template is highly customizable, so you can tailor it to your specific financial needs. Whether you’re managing a personal budget, a small business, this template can help you keep your finances in order.

With over 3000 downloads, we realized it was time to update this guide. We hope the new changes meet your expectations.

Table of contents

Why managing personal finances is important?

Managing personal finances is essential for achieving financial stability and ensuring long-term financial well-being. This process entails diligently tracking your income and expenses, creating a realistic budget, and making informed financial decisions.

Effective financial management empowers you to prevent overspending, reduce your debt load, and accumulate savings for emergencies, retirement, or other key financial objectives.

It equips you with a transparent overview of your financial health, allowing you to pinpoint areas where you can minimize expenses and strategize for upcoming costs or investment opportunities.

Moreover, with managing your personal or business finances, you can circumvent financial stress and anxiety, as it imparts a robust sense of control over your financial destiny.

This proactive approach enables you to make judicious decisions about your money, aligning your spending with your core values and ambitions.

In essence, personal finance management is a cornerstone of financial security, a bulwark against stress, and a stepping stone to realizing your long-term financial dreams.

It is an acquirable skill that can be refined with consistent practice and discipline. Utilizing tools like the Money Tracker Notion template can greatly simplify and optimize this meticulous process.

How to use the Finance Tracker Notion template?

To ensure accuracy and maximize efficiency, it’s essential to follow the step-by-step instructions detailed in the images below. Familiarizing yourself with these procedures will not only enhance your workflow but also ensure that you’re making the most out of the template’s capabilities.

Without a doubt, Notion’s Buttons feature stands out as a phenomenal tool that greatly simplifies our daily digital interactions. Its convenience is unmatched!

Add new Income

Add new expanse

How to Add category

Move sub category from one to another

Use the Budget to set spending limits and track progress

Unlock your finance with best budget techniques

Saving money and adhering to a budget is a common goal, but it requires a clear understanding of financial strategies that can assist us in reaching our monthly or yearly budget targets.

The benefits of using the Goals database to save for specific financial goals

Saving money is a crucial aspect of managing personal finances effectively. However, it can be challenging to save when there is no clear goal or purpose for the saved money. This is where the Goals database in the Finance Tracker notion template can be extremely helpful.

The Goals database allows you to set specific financial goals and track your progress towards achieving them. By having a clear goal in mind, you can focus your efforts and be more motivated to save money.

The database provides a place to set a name for each goal, the amount of money you want to save, a description of the goal, and the deadline for achieving it.

As you make progress towards your financial goals, you can use the “Live Feed” feature in the Goals database to track your progress and stay motivated.

The “Live Feed” Feature shows you how much you have saved so far and how much you have left to save to reach your goal.

How to add goal

For example, if you have a goal to save $5,000 for a down payment on a new car, you can create a new entry in the Goals database with the name “New Car Down Payment” and set the goal amount to $5,000.

You can then use the “Live Feed” feature to track your progress towards saving $5,000. As you save money each month, the “Live Feed” feature will update to show you how much closer you are to reaching your goal.

Using the Goals database can help you stay on track and motivated to save money. By setting specific goals and tracking your progress, you can make steady progress towards achieving your financial objectives.

How the Subscriptions can be used to track recurring payments?

The Subscriptions in the Finance Tracker Notion template is a powerful tool for managing recurring payments. Here are the steps to demonstrate how to use it:

- Add a new subscription: Click on the “Add a subscription” button to create a new subscription record.

- Enter subscription details: Enter the name of the subscription, the date it needs to be paid, the cost, and the payment frequency (e.g. monthly, quarterly, annually).

- Set up recurrence: Select the recurrence frequency (e.g. every 1 month) and the number of times it will recur.

- Set up next payment date: The “Next Payment Date” field will automatically populate based on the subscription date and recurrence frequency.

- View upcoming payments: The “Reminders” view from Subscriptions will display all the subscriptions with upcoming payment dates, allowing you to stay on top of your recurring payments.

Unlock Your Potential: Transform Your Life with Our Life Planner Notion Template!

Ready to level up your life? Our Life Planner Notion template is your ticket to success! Seamlessly manage goals, track progress, and take control of your future. Don’t just dream it, achieve it! Try it now and start living your best life today!

The benefits of using the Finance Tracker Notion Template

- Improved Financial Awareness: The template provides a clear view of all financial transactions and helps users to keep track of their spending habits. This increased awareness can help users make more informed financial decisions.

- Budgeting Made Easy: The Budget Database allows users to set limits on their spending and track how much they have left in their budget. This makes budgeting simple and easy.

- Goal-Oriented Savings: The Goals Database allows users to set specific savings goals and track their progress. This can help users stay motivated and focused on achieving their financial goals.

- Subscription Management: The Subscriptions Database makes it easy to track recurring payments and avoid missing payments or incurring late fees.

- Customizable and Scalable: The template can be easily customized to meet individual needs and can be scaled up or down as needed.

Take control of your finances with the help of this tool

Managing your personal finances can seem overwhelming and stressful, but it doesn’t have to be. By using the Money Tracker Notion template, you can take control of your finances and gain a clearer understanding of your spending habits. The template provides an organized system to track and analyze income, expenses, budgets, and financial goals, all in one place. With features such as the “live feed” you can follow your goals and budgets updated second by second, and track recurring payments, making it easier to plan for future expenses and save money.

By encouraging you to utilize the Money Tracker Notion template, you can take the first step towards taking control of your finances and achieving financial stability. With the ability to track and analyze your spending habits, set financial goals, and monitor progress, you can develop better financial habits and make informed decisions about your money. With the help of this tool, you can take the first step towards financial freedom and security.