Have you ever felt like your money is slipping through your fingers faster than a greased watermelon at a picnic? You’re not alone. According to a recent study, a staggering percentage of people struggle to manage and control their finances, feeling constantly bombarded by bills and unexpected expenses. This can lead to stress, anxiety, and even a sense of powerlessness over our financial future.

But fear not! There’s a powerful tool that can help you take control of your finances and finally feel like you’re winning the money game: budgeting. It may not be as exciting as a trip to the Bahamas, but budgeting can be your personal financial lifeline, helping you navigate the choppy waters of personal finance and reach your financial goals.

In this article, we’ll dive deep into the world of budgeting, exploring not only its benefits but also providing you with practical techniques that you can easily implement. We’ll also show you how to use these techniques effectively to gain control over your spending, allocate your resources wisely, and finally start planning for the future with confidence.

So, buckle up, grab your metaphorical financial life jacket, and get ready to learn how budgeting can help you transform your financial situation!

Unlock the Power of Budgeting and Take Control of Your Finances!

Before we dive into the nitty-gritty of budgeting techniques, let’s explore how it can become your trusted partner in achieving financial wellness. Budgeting isn’t just about restricting yourself; it’s about gaining control and empowering yourself to reach your financial goals.

Here are just a few of the powerful benefits of budgeting:

1. Freedom Through Control: Budgeting gives you a clear picture of your income and expenses, like a financial roadmap. This allows you to make informed decisions about your spending, set limits to avoid overspending, and reduce the stress associated with uncontrolled finances.

2. Prioritizing Your Needs: Budgeting isn’t about deprivation; it’s about prioritization. By allocating your resources wisely, you can ensure your money goes towards the things that matter most to you, whether it’s saving for a dream vacation, investing in your future, or simply ensuring your bills are always paid on time.

3. Building a Secure Future: Budgeting allows you to plan for the future by setting aside money for savings and investments. This proactive approach helps you weather unexpected expenses and build a financial safety net. Whether you’re dreaming of retiring comfortably, starting a business, or simply having peace of mind, budgeting is the foundation for a secure financial future.

Ready to Dive In? Explore These Powerful Budgeting Techniques!

Now that you understand the powerful benefits of budgeting, let’s explore some practical techniques to help you put those benefits into action. Think of these techniques as your financial toolkit, equipping you with the tools you need to take control of your finances and reach your goals.

Here are some popular and effective budgeting techniques you can try:

1. Zero-Based Budgeting

Imagine starting fresh with your finances each month. That’s the core principle behind zero-based budgeting. With this method, you allocate every single dollar of your income to specific categories, ensuring every cent has a purpose. This intentional approach helps you avoid unnecessary spending and focus on the areas that matter most to your financial goals.

Here’s how it works:

- List all your monthly income sources.

- Identify your spending categories (rent, groceries, transportation, etc.).

- Assign every dollar of your income to a category, ensuring your total allocated amount matches your total income.

- Review and adjust your allocations throughout the month as needed.

Unlock your finance with best budget techniques

Saving money and adhering to a budget is a common goal, but it requires a clear understanding of financial strategies that can assist us in reaching our monthly or yearly budget targets.

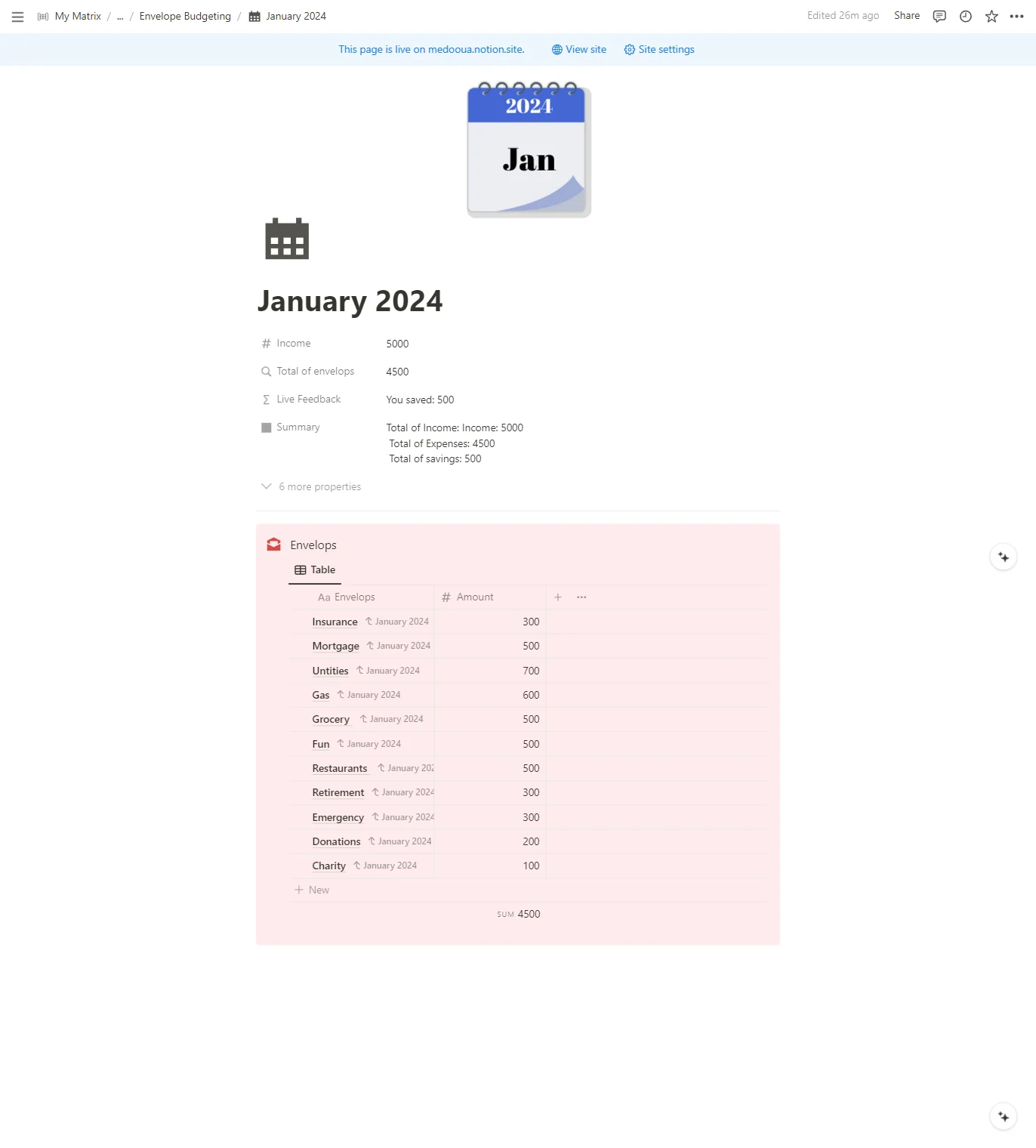

2. Envelope Budgeting

For some folks, seeing is believing – and that’s where envelope budgeting comes in! This technique is all about taking control of your finances in a tangible way.

Instead of relying solely on numbers in a spreadsheet, envelope budgeting involves physically allocating cash to different spending categories. Think of it as creating your own mini-budgeting system with envelopes for groceries, entertainment, transportation, and more.

Here’s how it works:

- Gather envelopes: Label each envelope with a specific spending category.

- Withdraw cash: Allocate the budgeted amount for each category in cash and place it in the corresponding envelope.

- Spend only what’s in the envelope: When you need to make a purchase within a category, use the cash from the designated envelope. Once the envelope is empty, you know you’ve reached your spending limit for that category in that period.

3. 50/30/20 Budgeting

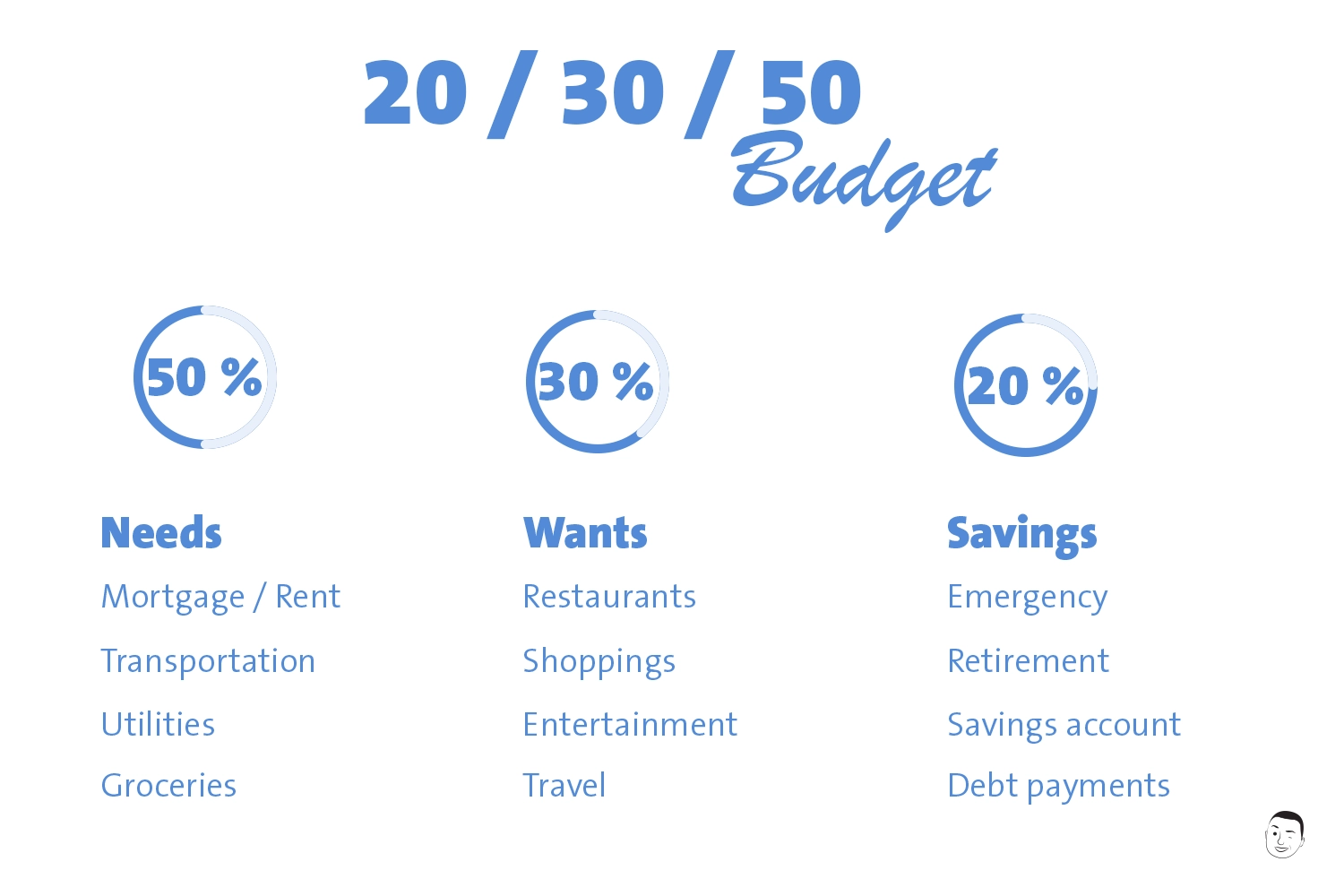

Finding the right balance between saving for the future and enjoying the present can be tricky. That’s where the 50/30/20 budgeting rule comes in! This popular technique offers a simple yet effective framework for allocating your income, ensuring you cover your needs, fulfill your desires, and prioritize your financial future – all at once.

Here’s how it works:

50% for Needs:

This category covers your essential expenses, like rent, utilities, groceries, transportation, and minimum debt payments.

30% for Wants:

This portion allows you to indulge in your desired lifestyle choices, such as entertainment, dining out, hobbies, or personal care.

20% for Savings:

This crucial section focuses on building your financial security by allocating funds towards savings goals (retirement, emergencies) and any existing debt payments.

Benefits of the 50/30/20 Rule:

Simplicity and ease of use:

The straightforward percentage breakdown makes it easy to understand and implement.

Balanced approach:

It encourages responsible spending while allowing for flexibility to enjoy your life.

Clear goal setting:

By allocating a specific percentage to savings, you can stay focused on your long-term financial goals.

Who should consider the 50/30/20 rule?

This budgeting technique is suitable for individuals who:

- Are new to budgeting and want a simple framework to get started.

- Seek a balanced approach to managing their finances.

- Want to prioritize both needs and savings goals.

4. The Envelope System

The envelope system takes the core principles of envelope budgeting and puts a modern spin on them. While the traditional method uses physical envelopes and cash, this variation embraces technology to offer a flexible and convenient alternative.

Instead of paper envelopes, you can use several digital tools, such as:

Budgeting apps: Many apps allow you to create “virtual envelopes” for different spending categories. You can allocate your budget electronically and track your spending within each category.

Spreadsheet software: You can create digital envelopes within a spreadsheet by assigning specific rows or columns to different categories and tracking your spending electronically.

Templates: Notion templates have great potential for tracking, planning, and saving your goals and notes. They can help you build your budget and financial systems.

Benefits of the Digital Envelope System:

- Easily access and track your spending anywhere, anytime.

- Adapt the system to your needs by creating as many virtual envelopes as needed.

- Some apps can automatically categorize transactions, simplifying expense tracking.

Who should consider the digital envelope system?

This system is ideal for individuals who:

- Prefer a tech-savvy approach to budgeting.

- Appreciate the convenience and accessibility of digital tools.

- Want to track spending on the go using their smartphones or laptops.

The envelope system is a variation of the envelope budgeting technique. Instead of using cash, you use envelopes or digital envelopes to allocate funds for specific expenses. By using the envelope system, you can easily track your spending and avoid overspending on unnecessary items.

The Pay Yourself First Technique

Imagine paying yourself first – before the bills, before the groceries, before any other expenses. That’s the core principle behind the Pay Yourself First technique. This strategy emphasizes taking control of your financial future by prioritizing savings and investments right from the start.

Instead of waiting until the end of the month to see what’s left over for savings, this technique encourages you to set aside a specific portion of your income as soon as you receive it. This ensures that your savings goals are automatically met, regardless of how the rest of the month unfolds.

Benefits of the Pay Yourself First Technique:

- Automated savings: You eliminate the temptation to spend your savings by setting them aside automatically.

- Long-term focus: By prioritizing savings, you stay focused on your financial goals like retirement, emergencies, or a down payment on a house.

- Habit building: This method helps you develop a consistent savings habit, making it easier to save for the future over time.

Who should consider the Pay Yourself First technique?

This system is ideal for individuals who:

- Struggle with procrastinating their savings.

- Want to automate their saving process.

- Have specific long-term financial goals they want to prioritize.

By paying yourself first, you can take charge of your financial future and ensure you’re consistently investing in your long-term goals.

Unlock your finance with best budget techniques

Saving money and adhering to a budget is a common goal, but it requires a clear understanding of financial strategies that can assist us in reaching our monthly or yearly budget targets.

How to Use Budgeting Techniques

Now that you’ve explored various budgeting techniques, it’s time to put them into action and empower yourself to take control of your finances! Here’s a roadmap to guide you through the process:

1. Know Your Numbers:

- Gather information about all your income sources, including salary, side gigs, investments, etc.

- Track your spending meticulously for a month to understand where your money goes. Categorize your expenses (rent, groceries, entertainment, etc.) for clarity.

2. Dream Big, Plan Smart:

Define Specific, Measurable, Achievable, Relevant, and Time-bound goals – like saving for a vacation in 6 months or paying off debt within a year.

3. Pick Your Weapon (Budget Technique):

Choose a technique that resonates with you, be it the structured approach of zero-based budgeting, the tangible control of the envelope system, or the flexible balance of the 50/30/20 rule.

4. Allocate and Track:

Allocate your income based on your chosen technique and financial goals.

Monitor your spending throughout the month to stay on track and identify areas for improvement. Many budgeting apps and tools can help with this.

Manage your Business With CRM Notion Template

A comprehensive CRM Solution. Effortlessly Manage Clients

✅ Manage Clients and Projects

✅ Ready to Fit with Your Product Inventories and Services

✅ Calendar for Meetings with Team and Clients

✅ User-Friendly Page Designs

5. Adapt and Conquer:

Review and adjust: Regularly assess your budget and spending habits. Be flexible and adjust your allocation or technique as needed to fit your evolving financial landscape.

Empowering Yourself, One Budget at a Time

Budgeting isn’t just about numbers and spreadsheets; it’s about taking control of your financial destiny. By embracing these practical techniques, you’ve equipped yourself with the tools to:

- Manage your spending with confidence

- Allocate resources effectively

- Plan for a secure and prosperous future

Remember, financial well-being is a journey, not a destination. Don’t be discouraged if it takes time and adjustments – celebrate your progress along the way! By consistently implementing these strategies and tailoring them to your needs, you’ll be well on your way to achieving your financial goals and building the future you deserve.

There are countless resources and tools available online and in your community to help you on your path to financial empowerment. Take charge, embrace the possibilities, and watch your financial future flourish!

Now that you’re armed with powerful budgeting techniques, are you ready to empower yourself and take your financial management to the next level? Look no further than Smart Budget Pro, our innovative Notion template designed to streamline your budgeting journey and help you achieve your financial goals faster!

Smart Budget Pro seamlessly combines the strengths of three popular budgeting techniques – the 50/30/20 rule, Zero-Based Budgeting, and Envelope Budgeting – into one comprehensive and user-friendly tool. This empowers you to choose the technique that best suits your needs while keeping your entire financial picture in clear sight.

Here’s what sets Smart Budget Pro apart:

Forget juggling multiple spreadsheets or apps. Smart Budget Pro leverages the power of Notion to seamlessly integrate the three budgeting techniques into a single, intuitive interface, making budgeting efficient and enjoyable.

Advanced Features:

Visualize your budget allocation: Gain instant insights into your spending habits with clear visualizations of your income and expenses for each category.

Track your progress: Monitor your financial progress effortlessly with monthly views and automatic calculations that save you time and effort.

Tailored for Success: Whether you’re a budgeting pro or just starting out, Smart Budget Pro provides the flexibility to customize your experience and achieve your unique financial goals.

Stop feeling overwhelmed by managing your finances. With Smart Budget Pro, you’ll be empowered to:

- Take control of your spending and make informed financial decisions.

- Save for your dreams, whether it’s a dream vacation, a down payment on a house, or a secure retirement.

- Gain peace of mind knowing you’re on the path to financial stability.

Have you tried the “Money Tracker” template as a digital wallet to keep track of your finances? It’s free to use.

Unlock Your Potential: Transform Your Life with Our Life Planner Notion Template!

Ready to level up your life? Our Life Planner Notion template is your ticket to success! Seamlessly manage goals, track progress, and take control of your future. Don’t just dream it, achieve it! Try it now and start living your best life today!