Financial knowledge is one of the most important skills you can possess in today’s world. It enables you to make informed financial decisions, plan for your future, and avoid financial pitfalls that can lead to debt and financial instability. In this article, we’ll explore the importance of financial knowledge and provide tips on how you can build your financial literacy.

Why Financial Knowledge Matters

Financial knowledge is the foundation of financial well-being. Without it, you may find yourself making poor financial decisions, overspending, and struggling to save for the future. Financial knowledge enables you to understand how to manage your money, budget effectively, and make informed decisions about investing, insurance, and retirement planning.

In today’s complex financial landscape, financial knowledge is more important than ever. With the rise of online banking and investing, it’s easier than ever to manage your finances from the comfort of your own home. However, this convenience also means that there are more financial products and services available than ever before, making it challenging to understand which options are best for you.

The Benefits of Being Financially Literate

Being financially literate has many benefits, including:

- Better Financial Decisions: When you have a good understanding of financial concepts, you’re better equipped to make informed financial decisions. This can lead to better financial outcomes, such as saving more money, avoiding debt, and making smart investment choices.

- Increased Confidence: When you understand how to manage your money, you’ll feel more confident in your financial decision-making abilities. This can help reduce financial stress and anxiety, and make it easier to plan for the future.

- Improved Financial Well-Being: By building your financial knowledge, you’ll be better equipped to manage your money, budget effectively, and plan for the future. This can lead to improved financial well-being, reduced financial stress, and a greater sense of financial security.

Building Your Financial Knowledge

Building your financial knowledge is an ongoing process that requires time and effort. Here are some tips to help you get started:

Master Pinterest & Social Media Growth

Enhance your online presence effortlessly by planning captivating posts, closely tracking your progress towards your goals, and significantly boosting engagement with our comprehensive, all-in-one tool. Experience the power of seamless content planning as you map out your strategy with precision and ease. Choose the smart way to manage your digital strategy and drive success with every post.

Tip 1 : Start with the Basics:

If you’re new to financial literacy, start with the basics. Learn about budgeting, saving, and managing debt. Once you have a good understanding of these concepts, you can move on to more advanced topics, such as investing and retirement planning.

Take Advantage of Free Resources: There are many free resources available online that can help you build your financial knowledge. Look for websites, blogs, and podcasts that focus on personal finance and financial literacy.

The “Money Tracker” template is an excellent tool for entrepreneurs and business leaders who want to take control of their finances and make informed decisions. By using this template, you can save time and effort while still building your financial knowledge and improving your financial health.

So if you’re looking for a free and easy-to-use solution to improve your financial literacy, give the Money Tracker template a try. With its intuitive design and powerful features, you’ll be on your way to financial success in no time.

Tip 2 : Attend Workshops and Seminars:

Many organizations offer workshops and seminars on financial literacy. These events can be a great way to learn from experts in the field and connect with other individuals who are also building their financial knowledge.

Tip 3 : Read Books and Articles:

Reading books and articles on personal finance and financial literacy can be a great way to learn about financial concepts in-depth. Look for books and articles that are written in a clear, concise manner and that are targeted towards your level of financial literacy.

Tip 4 : Read Books and Articles:

Finally, one of the best ways to build your financial knowledge is to practice good financial habits. This includes budgeting, saving, and tracking your expenses. By practicing these habits regularly, you’ll gain a better understanding of how to manage your money effectively.

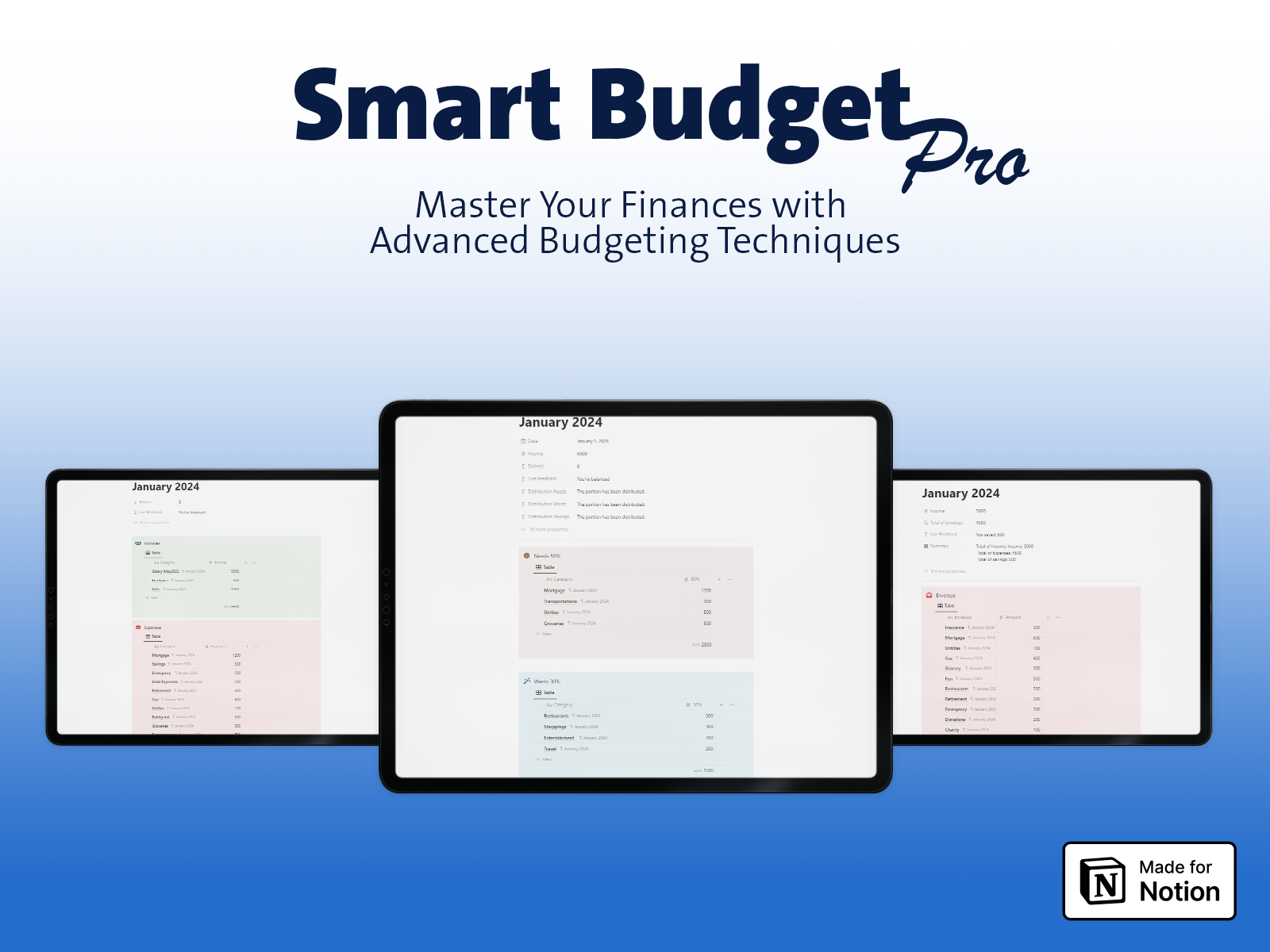

Unlock your finance with best budget techniques

Saving money and adhering to a budget is a common goal, but it requires a clear understanding of financial strategies that can assist us in reaching our monthly or yearly budget targets. By mastering effective budgeting techniques, we can unlock our potential to manage finances more efficiently.

Tip 5 : Don’t be afraid to seek professional help

Even with all the knowledge and tools available, managing finances can still be overwhelming. If you’re struggling with debt or making financial decisions, don’t be afraid to seek help from a professional. Financial advisors, credit counselors, and debt management specialists can provide guidance and support to help you make informed decisions and get back on track.

Tip 6 : Start investing early

Investing can be a great way to build wealth over time, but it’s important to start early. The earlier you start investing, the more time your money has to grow and compound. Even small investments made early on can turn into substantial savings over time.

Tip 7 : Diversify your investments

Diversification is key to a successful investment strategy. By spreading your investments across different asset classes, industries, and geographies, you can reduce your overall risk and potentially increase your returns. Don’t put all your eggs in one basket.

Tip 8 : Understand the impact of taxes

Taxes can have a big impact on your finances, so it’s important to understand how they work and how they affect your investments and other financial decisions. Consider working with a tax professional to develop a tax strategy that helps minimize your tax burden and maximize your savings.

Tip 9 : Stay disciplined and consistent

It’s important to stay disciplined and consistent in your financial habits. Set clear goals, create a budget, track your spending, and stick to your plan. Consistent effort over time is the key to achieving financial success.

Did you know that the “Money Tracker” template provides live feedback on each of your goals and budgets, reminding you to stay on track with how much you’ve spent or saved?

Manage your Business Effectively

Revolutionize Your Business Operations with Our Comprehensive CRM Solution. Effortlessly Manage Clients, Streamline Projects, and Optimize Sales with User-Friendly Tools and Seamless Communication. Take Control of Your Business Success Today!

Tip 10 : Keep an emergency fund

Life is unpredictable, and unexpected expenses can arise at any time. That’s why it’s important to keep an emergency fund. This is a savings account set aside for emergencies, such as car repairs, medical bills, or job loss. Aim to save at least three to six months’ worth of expenses in your emergency fund.

If you are using the “money tracker” template, consider creating an account named “Emergency” to help your finances grow. You can take pride in your progress toward financial health.

Tip 11 : Avoid debt as much as possible

Debt can be a major obstacle to achieving financial security. It’s important to avoid taking on more debt than you can handle and to pay off any existing debt as quickly as possible. High-interest debt, such as credit card debt, should be a priority to pay off first.

Tip 12 : Learn to negotiate

Negotiation skills can come in handy in many financial situations, such as when negotiating a salary or buying a car. Learning how to negotiate effectively can help you save money and get the best possible deal.

Tip 13 : Take advantage of free resources

There are many free resources available to help you learn about personal finance, such as online courses, podcasts, and blogs. Take advantage of these resources to expand your financial knowledge and stay up to date on the latest trends and best practices.

Have you tried the “Money Tracker” template as a digital wallet to keep track of your finances? It’s free to use.

Tip 14 : Review your finances regularly

Finally, it’s important to regularly review your finances to ensure that you’re on track to meet your goals. Review your budget, check your credit report, and track your progress toward your savings and investment goals. This can help you identify any areas that need improvement and make adjustments as needed.

Discover our Ultimate life Planner

A notion template has been built to manage your life goals and build your plans, helping to organize and manage your entire life. It keeps you focused on what’s important, builds your habits, and optimizes your life day after day, month after month, and year after year.

By following these 15 tips, you can gain the financial knowledge and skills you need to build a strong financial foundation and achieve your long-term goals. Remember, financial success takes time and effort, but with consistent effort and a commitment to learning, you can achieve your dreams and create a brighter financial future for yourself and your family.

One tool that can help you with your financial knowledge and management is the Notion template we built called “Money Tracker.” This template can help you keep track of your finances, set financial goals, and create a budget to achieve those goals.

With the “Money Tracker” template, you can easily monitor your spending and see where your money is going. You can also keep track of your income, savings, and debt to get a clear picture of your financial situation. The template also includes a budget section where you can set financial goals and track your progress towards those goals.

The reminders section of the template helps you stay on top of your bills and other financial obligations, so you never miss a payment or deadline. This can help you avoid late fees and maintain a good credit score.

Another section of the template is the accounts section, where you can keep track of all your financial accounts, including bank accounts, credit cards, and investment accounts. By having all your financial information in one place, you can easily see your overall financial picture and make informed financial decisions.

Finally, the template includes a records section where you can keep track of your financial transactions and view your financial history. This can help you identify areas where you may be overspending or where you need to adjust your budget.

In summary, the Money Tracker Notion template can be a valuable tool in your financial journey. By utilizing this template and following the 15 tips outlined above, you can gain the financial knowledge and skills you need to achieve your long-term financial goals and create a brighter financial future for yourself and your family.