Last updated on December 2nd, 2025 at 11:23 am

Let’s talk about budgets. Not the scary, restrictive kind that makes you feel like you’re on a financial diet. I’m talking about the kind of budget planner that feels like a warm hug for your wallet—a smart system that helps you save, spend wisely, and still enjoy life.

The truth is, most budgeting templates fail. In fact, I’d argue that 95% of them don’t work for the average person. Why? Because they’re either too complicated, too rigid, or just plain boring. They don’t account for the messy, unpredictable reality of life.

But don’t worry—I’ve got you covered. In this post, I’ll explain why most budgeting templates fall short, introduce you to popular budgeting methods (like the 50-30-20 rule, zero-based budgeting, and envelope budgeting), and show you how my personal budget template in Notion (yes, it’s free!) solves all these problems—plus includes a powerful budget tracker to keep your finances on track.

Let’s dive in.

Why Most Budgeting Templates Fail

1. They’re Too Complicated

Have you ever opened a budgeting template or app and immediately felt overwhelmed? Columns, formulas, categories, subcategories—it’s like trying to solve a math problem you didn’t sign up for.

Budgeting doesn’t have to be rocket science. But most budget planners make it feel that way. They assume you have hours to dedicate to tracking every penny, and let’s be real—most of us don’t.

Unlock your finance with best budget techniques

Saving money and adhering to a budget is a common goal, but it requires a clear understanding of financial strategies that can assist us in reaching our monthly or yearly budget targets.

2. They’re Too Rigid

Life is unpredictable. One month it’s car repairs. The next, it’s an impromptu trip or birthday dinner. Most personal budget templates don’t offer room for flexibility. They lock you into fixed categories and structures that don’t fit real life.

3. They Don’t Teach You Anything

A good budget planner isn’t just about tracking—it’s about learning. But most templates are just calculators. They don’t help you understand where your money goes or how to improve your habits.

4. They’re Not Personalized

You’re unique. Your financial goals, lifestyle, and income patterns aren’t one-size-fits-all. Yet most budgeting templates act like they are. A freelancer budgeting for variable income needs a very different system than a 9-to-5 employee.

5. They’re Boring

Let’s face it: if your budget doesn’t inspire you, you won’t stick with it. Dull spreadsheets and lifeless dashboards won’t motivate anyone. A successful budget tracker needs to feel engaging and rewarding.

Unlock your finance with best budget techniques

Saving money and adhering to a budget is a common goal, but it requires a clear understanding of financial strategies that can assist us in reaching our monthly or yearly budget targets.

Popular Budgeting Methods (and Their Pros and Cons)

Before I introduce you to my free budget planner in Notion, here are a few budgeting styles you might recognize—and their pros and cons.

1. The 50-30-20 Rule

A classic personal budget template approach:

- 50% for needs

- 30% for wants

- 20% for savings and debt

Pros: Simple and flexible.

Cons: Too broad for detailed tracking.

2. Zero-Based Budgeting

Every dollar gets a job. You budget down to zero.

Pros: Super intentional. Great for control freaks.

Cons: Not ideal for irregular income. Can feel too strict.

3. Envelope Budgeting

Cash-based. Physical envelopes (or digital versions) are used for spending categories.

Pros: Helps prevent overspending.

Cons: Impractical for digital purchases or modern banking.

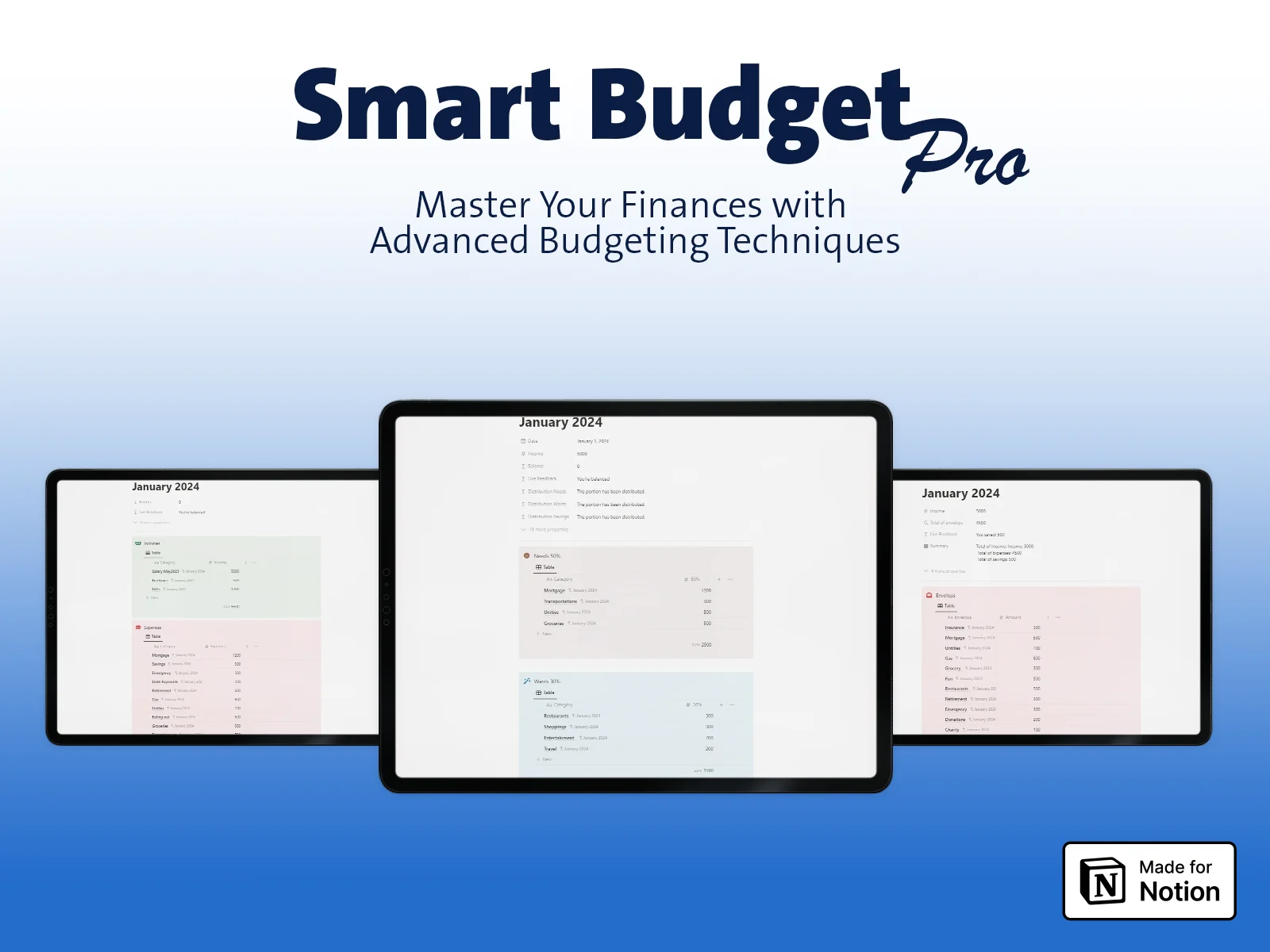

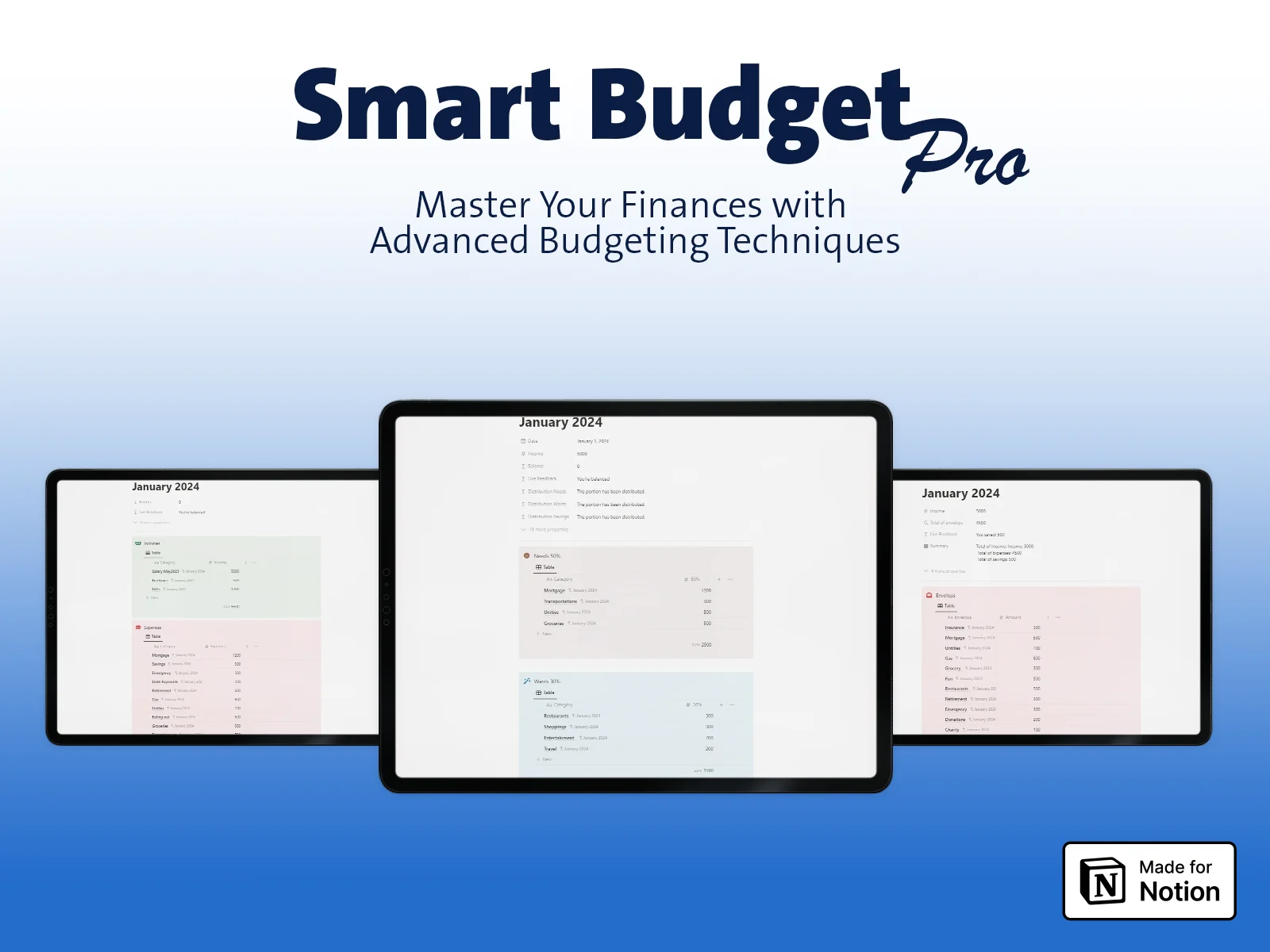

Introducing Notion Budget Planner Template

Now, let’s talk about something that actually works: my free budget planner built in Notion.

It’s a personal budget template that’s flexible, visual, customizable, and—yes—way more fun than a spreadsheet.

1. It’s Simple and Friendly

No complicated setup. The layout is intuitive, and the instructions walk you through everything step-by-step.

2. It’s Flexible and Realistic

Whether you’re using the 50-30-20 rule or a zero-based method, this personal budget template lets you adapt and evolve. Need to add a new category or account for surprise expenses? Easy.

3. It Teaches You

My template includes mindset prompts and money habit check-ins. It’s not just a budget tracker, it’s a tool for financial growth.

4. It’s Fully Customizable

Freelancer? Side hustler? Shared finances? No problem. This budget planner was designed for personalization. Adjust categories, income sources, and savings goals to match your life.

5. It’s Motivating and Visual

With built-in budget trackers, visual progress bars, and even space to celebrate wins, this Notion template makes budgeting feel like progress—not punishment.

How to Use This Free Budget Planner in Notion

Set Up Your Income and Fixed Expenses

Add your income streams and core bills like rent, subscriptions, utilities, etc.

Track Spending with the Budget Tracker

Log daily or weekly expenses. Watch categories update automatically so you stay aware (without obsessing).

Set and Monitor Savings Goals

Whether you’re saving for a trip, emergency fund, or debt payoff, use the template’s budget tracker to visualize progress.

Review and Adjust Monthly

Reflect on where your money went. Look at what worked, what didn’t, and tweak your categories for next month.

Why This Personal Budget Template Actually Works

This Notion-based budget planner is more than just a tool—it’s a system for self-awareness and financial clarity. It blends flexibility with structure, habit with motivation, and practicality with simplicity.

Unlike traditional budgeting templates, it won’t frustrate or bore you. It will empower you.

Why This Personal Budget Template Actually Works

Budgeting doesn’t have to be complicated or discouraging. With the right system—a flexible, engaging personal budget template—you can create a budgeting habit that actually sticks.

If you’re tired of stale spreadsheets and apps that don’t “get” your life, try something smarter. Download my free Notion budget planner today and experience a better way to manage your money.

Ready to take control?